Wall Street Wildlife : Bears, Bulls, Black Swans & More

- Manal Shah

- Mar 13, 2020

- 5 min read

“Even apart from the instability due to speculation, there is the instability due to the characteristic of human nature that a large proportion of our positive activities depend on spontaneous optimism rather than mathematical expectations, whether moral or hedonistic or economic. Most, probably, of our decisions to do something positive, the full consequences of which will be drawn out over many days to come, can only be taken as the result of animal spirits—a spontaneous urge to action rather than inaction, and not as the outcome of a weighted average of quantitative benefits multiplied by quantitative probabilities.” - John Maynard KeynesBull and Bear

Bull and bear are the most commonly used in the context of market trends. Bull charges ahead ignoring anyone in his path, this mentality in the stock market drives stock prices high and bullies others into higher investments. Thus the term bull market is an optimistic one, which reflects an improving economy with an underlying belief that stocks will climb higher. A bull charges ahead, thrusting horns upwards, looking upwards. Bullish trend thus implies where stock prices are increasing and money is flowing into stocks. A Bullish market sees high investor confidence. It is typically an improved market performance over a period of months or years and can be in the context of the market as a whole or just a particular stock. Bull market signals to strengthen the economy.

A Bear, on the other hand, tears things down with his claws. Similarly, a bull market reflects shredding hopes and confidence with bullish investors selling or short selling everything, thus bringing down prices across the board. This trend reflects pessimism toward market performance. Bears, swipe down their prey, tearing it as in this case, and market confidence to shreds filled with pessimism and negative sentiment. Typically the threshold for a bear market is a more than 20% downturn by major indices like S&P 500 or Dow Jones Industrial average over two months.

Typically investors and markets shift between these two modes, depending on various factors including global economic concerns and financial performance.

Wolf

Wolf is a ferocious animal. Wolf in Wall Street lingo refers to someone hungry to reach the top and ruthlessly making money, be it criminally, unethically or fraudulently.

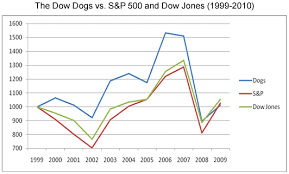

Dog

Dog refers to an underperforming stock, purchasing which does not make sense. However, there is a Dogs of Dow theory that says that if you buy a dog with the highest dividend yield in Dow 30, it might result in a turnaround of about 15% in fifteen years.

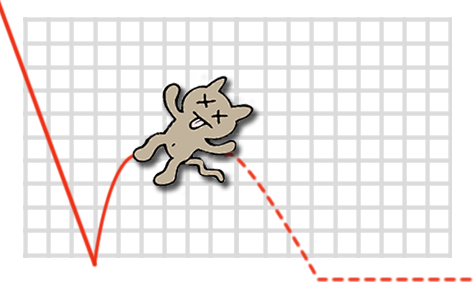

Dead Cat Bounce

A dead cat bounce refers to temporary recovery in the stock price of a falling stock which gives hope that it might come back up. However, with dead cat bounce, the stock might plunge again, lower than it was earlier.

Hawk and Dove

A Hawk as a bird is powerful and aggressive. In Wall Street context, a Hawk refers to a policymaker or regulatory who is predominantly concerned with economic growth than with recessionary pressure brought to bear with the same. In an economic sense, a hawk believes that interest rates are better high in order to keep inflation in check, they favour tightening of monetary policy. They watch interest rates and inflation with a close eye.

Contrastingly, a dove as a bird is gentle and tame. A Dove on Wall Street holds the belief that low-interest rates stimulate the economy, even if it leads to inflation. These are economic policy gurus advocating for lower interest rates and belief that inflation would have minimal negative impact on society. They are more tolerant of price inflation.

Lame Duck

This phrase can be traced back to 18th Century London Stock Exchange to refer to traders who defaulted their debt. Refers to an out of use term referring to a trader having defaulted on a debt or gone bankruptcy due to inability to cover trading losses. Refers to traders who had injured themselves financially in the market waddled away from the exchange. The descriptor of the underfinanced business scheme, this term is used to refer to a trader who ends up with huge losses, defaulted debts or bankruptcy.

Black Swan

A Black Swan is a rare unpredictable event with serious implications on the economy. Nassim Nicholas Taleb[1]popularized this term, examples of these events are WWI, WWW, 2008, 9/11. The recent market crashes around the world are due to the coronavirus pandemic. These events result from prolonged conflicts, bring in uncertainty and cause severe repercussions. In a Black Swan event, the market deviates beyond what is normally expected and extremely difficult to predict. At times like these, risk management models on historical data become useless. The name goes due to the assumption that all swans are white risk model.

Chicken

Like childhood usage, Chicken on Wall Street refers to investors who are scared by nature and would rather sit on current portfolios, than making changes despite a good chance of turning nice profits.

Pigs

Pigs refer to rich and high-risk investors who wish to make as much money in the shortest time possible. They invest based on tips and emotions rather than on studied background of the company. It also reflects the greed and impatience and these investors often lose big in the market. Just like the pig in farmland that overindulges in feed, this kind investor will hold onto an investment even after a substantial movement, in hope that the investment will provide even greater gains.

Ostriche

When in danger, Ostriches, as an animal chose to bury their heads in the sand and wait for the danger to pass. Thus the term Ostriche in Wall Street describes investors who ignore negative and threatening information and do nothing but hope that their portfolios are not hit too hard. They fail to react to critical situations or events that have the likelihood to impact his/ her investments. These traders tend to appear (or disappear) more frequently during the bear markets where people experience most financial stress.

Sheep

A sheep as an animal is not a leader but a follower and can be eaten by a bull or a bear, it needs a shepherd for guidance. Similarly, Sheep is a term used to describe such investors that are not leaders but followers and rely on advice from family, friends and financial market pundits, market trends. They often suffer because of foul advice or late action. These type of investors do not have any strategy or focus and miss out on meaningful moves in the market. Their lack of research leads to lack of confidence in their ability to make investment decisions, thus making them reliant on the guidance of others.

Stag

A stag is a short term spectator who buys and sells stocks very quickly, typically within a few hours of the day. These male deers, need huge cash to play the market at the speed that they do. They depend on taking advantage of small price movements.

Zebra

Zebra as animals do not change their stripes. Thus, a Zebra of Wall Street is investor/ manager who sticks to the plan and rarely changes their strategies.

Vulture

A vulture is a seller of securitized viaticals. Additionally, a vulture capitalist refers to an investor who buys companies in or near bankruptcy with a view to save them or one who buys the rights to a new product or invention in order to profit from its sale. It is derogatory as they deprive inventors of the money they would otherwise make.

Scorpion

Taken from Aesops Fable of ‘the Scorpion and the Frog’, the scorpion can’t help but sting the frog because of its inherent nature to do so. Refers to the revelation that Wall Street time and again stings the entire nation in its quest for profits.

Lion

Similar to when a Lion’s roar that everyone listens, Lion in Wall Street refers to persons of power. For example, when persons occupying top positions of let’s say, Morgan Stanley or Goldman Sachs talks, people listen.

[1] https://www.ft.com/content/26345fa6-7d67-11dc-9f47-0000779fd2ac(last accessed on 18.03.2019

Comments