Effective exclusion of fugitive economic offenders from the Securities Markets

- Manal Shah

- Apr 28, 2019

- 5 min read

Economic Offence in India

An Economic Offender (“EO”) forms a distinct class of crimes among criminal offences. Economic Offences not only inflict pecuniary fatalities on individuals but also damage the national economy and raise security implications. There have been several instances of EOs absconding the jurisdiction of Indian Courts anticipating the commencement of criminal proceedings or, at times, during the pendency of such proceedings. The absence of such offenders from Indian courts has several deleterious corollaries, in that the absenteeism hinders investigation in criminal cases, wastes valuable court time and undermines the rule of law. Furthermore, most economic offences involve defaulted bank loans thus decline in the financial health of the banking sector. The number of fraud cases reported by banks, that typically averaged around 4,500 cases a year in the past 10 years soared up to 5,835 cases in 2017-18. It was estimated that the banking and finance sector suffered losses of a staggering amount of INR 41,000 Crores due to fraud.

Menace of Fugitive Economic Offences in India

As per data from the Ministry of External Affairs (December 2018), there are forty-one absconding persons accused of various scams/ frauds/ under the proves by the Enforcement Directorate/ CBI which include Vijay Mallya (INR 9000 Crores owed to Indian banks), Christian Michel James, Nirav Modi (2 Billion USD owed to Indian banks), Mehul Choksi, Ashish Sureshbhai Jobanputra, Mrs Priti Ashish Jobanputra, Shri Ramachandran Viswanathan, M.G. Chandrasekhar, Sanjay Bhandari, Nitin Jayantilal Sandesara (INR 5300 Crores scam), Chetan Jayantilal Sandesara, Dipti Chetan Sandesara. Hiteshkumar Narendrabhai Patel, Deepak Talwar, Deepa Talwar, Sunny Kalra, Aarti Kalra, Sanjay, Jatin Mehta, Lalit Modi (scam involving about INR 1700 Crore), S. Harpal Singh Dutta, Ritesh Jain (scam involving INR 1500 crore) The Government has made several efforts for securing presence of these accused in the country, e.g. issuance of LOC, RCN and Extradition requests.

The Savior Legislation

With a view to addressing this quandary, The Fugitive Economic Offenders Act, 2018 (“FEO Act”) was enacted. The Act defines a Fugitive Economic Offender (“FEO”) as an individual against whom a warrant for arrest has been issued by any court in India in relation to a Scheduled Offence[1] and where the individual has either left India to avoid the criminal prosecution or being abroad, has refused to return to India to face the criminal prosecution. These Schedule Offences (including counterfeiting of currency and valuable securities, financial scams and frauds, money laundering, hawala transactions etc) encompass entries including the offences under the Indian Penal Code, 1860; the Reserve Bank of India, 1934; the Central Excise Act, 1944, the Prevention of Money Laundering Act, 2002; the Black Money (Undisclosed Foreign Income and Assets) and Imposition of Tax Act, 2015, among others. Offences under the Securities and Exchange Board of India Act, 1992 such as the prohibition of manipulative and deceptive devices, insider trading and substantial acquisition of securities and control also form part of the Scheduled Economic Offences for the purposes of the FEO Act.

The FEO Act lays down measures to dissuade economic offenders from evading the process of Indian law by remaining outside the jurisdiction of Indian courts and to ensure that FEOs return to India to face action in accordance with the law. The Act provides for firstly, attachment as well as confiscation of property of an FEO and the proceeds of his crime, secondly, the powers relating to survey, search and seizure as well as a search of people vested with the Director, thirdly, disentitlement of the FEO from putting forward or defending civil claims, fourthly, the appointment of an Administrator for the legislation and finally, appeal provisions vesting appellate authority with the high court against the orders issued by the special court and finally, placing the burden of proof for establishing that an individual is an FEO on the director/ persons authorized by him.

Action under the FEO Act has also been initiated in suitable absconders’ cases. January 05, 2019, the PMLA Court declared Vijay Mallya as an FEO under the FEO Act 2018.

How the Securities Market Regulator reacted

SEBI deliberated on this issue[2] and imposed several restrictions on FEOs in relation to access of the securities markets, majorly by way of enacting the SEBI (Issue of Capital and Disclosure Requirements) Regulations 2018 (“ICDR”) and amending the SEBI (Substantial Acquisition of Shares and Takeovers) Regulations 2011 (“Takeover Code”).

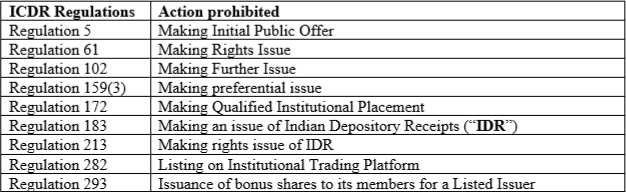

Insertion of Regulation 6A to the Takeover Code has prohibited an FEO from making a public announcement of an open offer/ making competing for an offer for acquiring shares/ entering into a transaction (directly or indirectly) for the acquisition of shares or voting right or control of a target company. ICDR 2018 bars an issuer whose promoter/ director includes an FEO from various activities as follows:

Exile from Settlement for FEOs

Settlement for securities law violations introduced in 2007 to provide an effective mechanism, the essential concomitants of a legal proceeding, without compromising on deterrence or providing equitable remedies to the affected investors. The Settlement process was codified into the SEBI (Settlement of Administrative and Civil Proceedings) Regulations 2014. It led to the convergence and integration of the quasi-judicial processes within SEBI with alternate dispute resolution process of settlement and brought forth a more effective harmonized scheme to operate with less conflict and delay. Though certain shortcomings were noticed over a period of time, overall, these regulations were a major advancement in the introduction of a mathematical and transparent system of calculating the settlement amount, however, certain shortcomings were noticed over a period of time. With a view to repair these wears and tears in the Settlement Regulation, SEBI introduced the SEBI (Settlement Proceeding) Regulations 2018 based on the Report on the Settlement Mechanism of the High-Level Committee under the Chairmanship of Retd. Justice A.R. Dave. Notably, Regulation 5(4) of the 2018 Regulations barred FEOs from settlement proceedings alongside wilful defaulters and defaulters in payment of fee due/ penalty imposed under the Securities laws.

Comments

Thus as it stands, on being declared as an FEO, the restrictions imposed by SEBI under the Takeover Code, the ICDR and the Settlement Regulations would by default be imposed on the respective accused.

It was pertinent and much needed that FEOs be barred from participating in securities markets after committing such serious frauds on the market and its investors and evading not only the markets but also the Rule of law. SEBI has made commendable stride by barring FEOs from the securities markets and from availing the benefit of Settlement Proceedings.

Alongside these restrictions being imposed on the FEOs coupled with the seizure and freezing provisions under the FEO Act, extradition acts catalytically to resolving these cases. Extradition, which is the surrender by one state to another of a person desired to be dealt with for crimes for which he has been accused of convicted and which are justifiable in the courts of the other state is codified by the various Extradition Treaties signed by the Indian Government with other Governments. Additionally, the states with whom India does not have an Extradition Treaty is provided by the Extradition Law (‘the Indian Extradition Act, 1962’).

[1] An offence involving an amount of one hundred crore rupees or more.

[2] Vide SEBI’s meeting held on June 21, 2018.