BSE & NYSE: Tales 'from under the Banyan Tree'

- Manal Shah

- Jan 21, 2019

- 3 min read

At the heart of the Financial Capital of the world’s seventh biggest economy and home to many conglomerates, Mumbai stand a few iconic buildings, one such building is located on a crowded Dalal Street (translated as Brokers Street) and belongs to the Bombay Stock Exchange (“BSE”). This Powerhouse has a market capitalization of INR 1,39,46,745.58 Crores and stands proud. When you walk past the sprawling street, it takes you in an awe.

More than half a decade ago, five stock brokers in Mumbai would gather around a banyan tree (in what is commonly known as Horniman Circle) opposite to the Town Hall/ Asiatic Library. To the general populace, who looked like a strange set of brokers with bucket loads of money, laid foundation to the present day BSE.

(For image source, click here)

Over time, the group increased in size, the venue for their meetings moved to a hired hall in a building then known as Advocate of India on the Dalal Street. In 1875 this group of stock brokers which had increased to over a hundred brokers, received official recognition giving birth to ‘The Native Share and Stock Brokers Association’.

In its early days, these brokers mainly handled the limited volume of trading in banks, textile and cotton mills with Cotton being a prime business with more than half of the cotton production of the then India being marketed through Bombay. Early dais saw trading of shares of textile mills such as Oriental Mills, Maneckji Petit Mills, Lakhmidas Khimji Mills, Mazgaon Mills and companies such as Colaba Press and Fort Press.

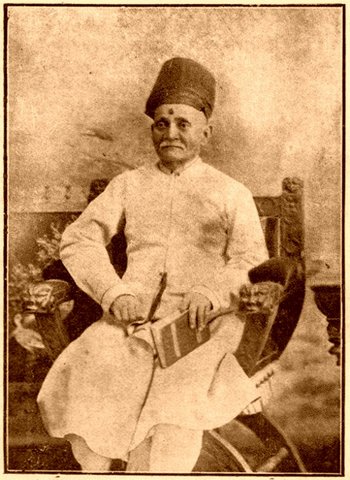

India’s first stock broker was a Seth Premchand Roychand from a family of modest means. He hailed from Surat to Bombay to work with a successful broker, eventually becoming one himself. He was the first share broker who could read and write in English.

(For image source, click here)

It is noteworthy that, back then, barely any brokers had bank accounts because at the time, banks didn’t cater to locals, making it difficult to handle payments. The then honorary Secretary and Treasurer Jamnadas Morarjee, then proposed all payments to the exchange be made through cheques. Morarjee was also instrumental in pushing for Clearing House system in BSE which became operational in 1921.

BSE went on to become India’s first recognized Stock Exchange under the Securities Contracts Regulation Act and first in the world to introduce centralized internet trading system allowing investors from all over the world to trade on its platform. It is now the 10th richest stock exchange in the world with the willpower and spirit revolving around money, much like Mumbai City.

New York Stock Exchange

NSE stands tall at the Wall Street with its Market Capitalization standing at USD 28,528,761. May 17, 1792 when twenty four stock brokers met under the shade of a Buttonwood Tree outside at 68 Wall Street to sign an agreement to only trade with each other and to represent the interest of the public. This agreement that birthed the New York Stock Exchange is now commonly called the Buttonwood Agreement. The NYSE started its operation with five securities traded in the New York City with the first listed company being the Bank of New York. NYSE today boasts of its 27.3 Trillion Market Cap with 98% of Energy/ Utilities, 89% of Industrials, 67% of Consumer Goods, 72% of healthcare and 41% of TMT.

(Image source, click here)

Text from the Agreement:

WE the Subscribers, Brokers for the Purchase and Sale of Public Stock, do hereby solemnly promise and pledge ourselves to each other that we will not buy or sell from this day for any person whatsoever, any kind of Public Stock, at a less rate than one quarter per cent Commission on the Specie value and that we will give a preference to each other in our Negotiations. In Testimony whereof we have set our hands this 17th day of May at New York. 1792.

Women of NYSE and BSE

May 25, 2018. NYSE got its first female president Stacey Cunningham. Cunningham first set foot on the exchange floor in 1994 as an intern. She told the Time, “The New York Stock Exchange history runs back 226 years, women have not been a big part of that history”.

While Cunningham’s story is widely covered, Deena Mehta’s has gone unheard. Mehta was the first woman president of the BSE. In her interview with Times Now News, she discussed about the resistance she faced while trying to introduce faster settlements and centralized bad delivery cells. Mehta’s love for the market led her to be the first woman to have entered the trading ring, to be elected to the board and to become the President of the BSE.

While it is good to see the times are evolving, and with it, the Stock Market community. May these women be an example to an army of women stock brokers and executives of stock exchanges globally.

Reads:

Deena Mehta-

1. https://www.bbc.com/news/av/world-asia-39209952/india-s-first-female-stockbroker-who-went-to-the-top?ocid=IndiaDirect_FemaleStockbroker_Mobile_Keywee_&kwp_0=362628

2. https://www.timesnownews.com/business-economy/markets/article/deena-mehta-first-bombay-stock-exchange-president-contributions-international-womens-day/205790

Stacey Cunninham:

http://time.com/5362170/stacey-cunningham-nyse/

Comments