Economic Downfall & Rising Stock Markets - A Contrariety

- Manal Shah

- Jun 17, 2020

- 3 min read

Dhanishta Mittal is a B.A. L.L.B. candidate at NALSAR University of Law, Hyderabad, India.

Deepanshu Mittal is a Chartered Accountant and a prospective MBA applicant.

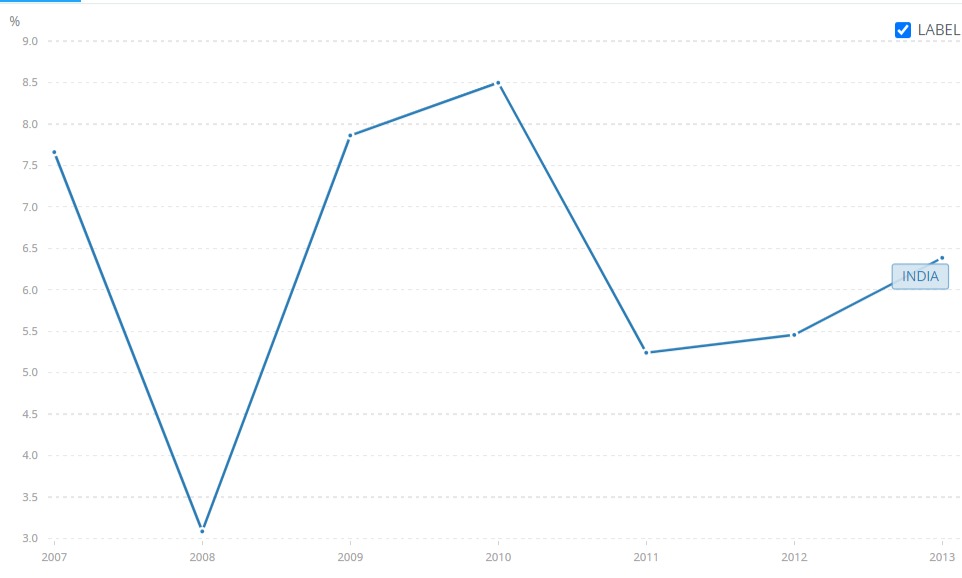

Take a look at these 2 charts. Figure 1 shows the economic movement whereas Figure 2 represents the stock movement of SENSEX for the same time period. The movement of these 2 graphs is identical.

This was the time of the Global Financial Crisis of 2008. The economy and stock markets suffered an immediate blow followed by recovery and an increase in the aforementioned indicators. So why are we witnessing such a huge disparity between the stock market and economic indicators despite the economic slowdown due to the pandemic?

NIFTY crossed the 10000 mark in the June of 2020 and SENSEX has reached over 34000. That is close to 20% return in 2 months. On the other hand, Centre for Monitoring Indian Economy (‘CMIE’), declared that the unemployment rate was nearly 26.2%. According to the Ministry of Statistics and Programme Implementation (‘MSPI’), the GDP growth rate is estimated to be at 3.1% which is similar to that of the 2008 levels.

To understand the disparity, it is imperative to understand the functioning of the stock market. Stock Market represents listed companies, and the indexes are composed of companies from various sectors. Factors which affect the companies will inevitably have an impact on economic indicators as the earnings of the companies impact the GDP of the country. Thus, better economic conditions are conducive to increased earnings which raise employment and better consumer spending power, furthering the GDP. This holds true vice versa too.

Despite such a direct co-relation, why is there an evident disparity? Stock markets are prices as on a certain date. It reflects the sentiments of investors about the future prospects of the economy. It can be argued that stock markets provide a vision into the future of the economy. Let’s revisit the data. The unemployment rate as in April 2020 was 26.2%. The expected GDP growth rate mentioned earlier is for the first quarter which is almost over. To compare the two indicators, we need to take a look at the data which reflects the correct time period. This is the reason why the two graphs appear to move in tandem when they are compared. But the stock markets began their recovery way before the economists released their data. The time difference creates a perception that stock markets are rising even despite being in an economic crisis.

The movement of stock markets is not just triggered by corporate earnings or trading models but is also fuelled by investor sentiments. Since the countries are in a state of lockdown and are fighting their way through the pandemic, positive news surrounding vaccine developments and estimated dates of its arrival in the coming few months also bring positivity. Investors enter the market early, to maximise their gains out of such a move. Thus, the investors assume that the anticipated arrival of vaccines in September of 2020 could normalise the situation in the year itself. This will boost the desired recovery which will inevitably raise the stock prices. This raises the demand for the stocks and consequently raises the prices on the stock exchange.

Moreover, the Reserve Bank of India (‘RBI’) has resorted to decreasing the repo rates which currently stand at 4%. This reduces the interest rates offered by various banks and other public investment schemes. The interest rates also affect the bond market negatively which leaves equity as an attractive investment opportunity for various retail investors. The low-interest rates also offer attractive loan opportunities for companies to capitalise, which should drive their revenues and profits, thereby increasing their stock prices.

Stock markets are not reflective of the economy. They will never be. Stock markets only represent a part of the economy, more so, the advanced one. There are other factors which contribute to economic development which does not affect the stock market by and large. However, stock markets do provide us with an insight towards the direction of the economy. It reflects the current consumer sentiments which the economic indicators have yet to account for. In other words, economic indicators like GDP growth rate, tell us what happened in the past, whereas the stock markets tell us what might happen in the future. And when we project the figures on the graph, the final result does not reflect a huge disparity.

The opinions expressed herein are those of the author in their personal capacity and are not intended to be construed as legal, financial or investment advice.

An explanation for rising stock markets could be increasing retail investments. The lockdown has forced a lot of professionals to work from home, which has given them an opportunity to try their hands at the stock market. An increasing number of retail participants is also increasing the strain on brokers such as Zerodha, who are functioning at peak capacity (The Ken has a lovely piece on this).