Recapitalization of PCA Banks

- Manal Shah

- Mar 4, 2019

- 2 min read

[ Reference to https://indiacorplaw.in/2018/11/prompt-corrective-action.html ]

India’s Central Bank, the Reserve Bank of India (“RBI”) vide Press Release No. 2018-2019/2034 dated February 26, 2019, declared the removal of Allahabad Bank and Corporation Bank as well as Private Sector Dhanlaxmi Bank out of the Prompt Corrective Action (“PCA”) framework. Earlier on February 26, 2019, RBI vides Press Release no. 2018-2019/1807 dated January 31, 2019, had removed Bank of India and Bank of Maharashtra out of the PCA framework. These banks, on a performance review, were found not in breach of the PCA thresholds and would be subject to certain conditions (maintaining minimum regulatory capital, net NPA and leverage ratio on an ongoing basis) and close monitoring placed by the RBI. RBI also removed restrictions placed on Oriental Bank of Commerce under the framework, subjecting it to certain conditions and close monitoring.

Above banks are not in breach of any PCA thresholds except Return on Assets (RoA), which has been reasoned by the RBI to be a part of Capital to Asset Ratio. At present, six public sector banks remain within the PCA framework (United Bank of India, IDBI Bank, UCO Bank, Central Bank of India, Indian Overseas Bank and Dena Bank).

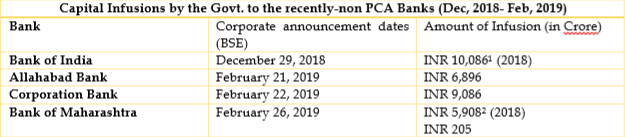

Capital Infusions by the Govt. to the recently-non PCA Banks (Dec 2018- Feb 2019)

At least for the moment, the health of PSBs have improved in light of its desperate need of recapitalization being met by the Government.

Author’s concern stands to the point of pushing these PSBs to lend amid weak credit demand, would result elusively. It is pertinent that the revival of these PSBs follows a well-thought-out process. (Zimmermann and Schafer) studied a bad bank plans of the German Government and discussed the three key challenges an efficient corrective plan must address[3] Firstly, it has to provide for the transparent removal of toxic assets and give the remaining good banks a fresh start. At the same time, the cost to tax-payers has to be kept at a minimum. Finally, the risk of future moral hazard has to be curtailed. Recapitalization should go hand in hand with active management of these assets, the involvement of financial experts who know how to deal with such assets and implementation of a clear governance structure.

Recapitalization should not become a tool limited to the purchase price, the securing of additional time to sell assets at an opportune moment and the governance structure.[4] In this regard, a good thing about the abovementioned capital infusions is that it is spending taxpayer’s money only for shares of the reviving banks.

Systemically relevant banks would be forced to become part of the programme, depreciate and restore their capital basis.[5] As a precautionary move, in addition to recapitalization, certain other measures would ensure the systematic revival of these banks and avoid them from falling back into the framework. These include, as suggested by Zimmermann, entrusting external experts with management and most importantly, to encourage and facilitate these banks to pursue a sustainable business model along with a new regulatory framework.

[1] http://pib.nic.in/newsite/PrintRelease.aspx?relid=186589 (last accessed 03.03.2019).

[2] Ibid.

[3] Zimmermann, D. S. (2009). Bad Bank(s) and the Recapitalisation of the Banking Sector. Intereconomics, 12.

[4] Ibid.

[5] Ibid.

Comments