SEBI Relaxations during Covid-19 Pandemic

- Manal Shah

- Apr 29, 2020

- 4 min read

Yash Tandon, Student of 4th Year, B.A LLB. Hons at Tamil Nadu National Law University, Tiruchirappalli.

The unprecedented event of the Covid-19 pandemic has resulted in a lockdown throughout the nation, which has, in turn, compelled the Government to order a shut down of establishments and physical offices. As a result of these turn of events, employees have been driven to work from home, creating a number of difficulties. For instance, the companies facing difficulties in undertaking timely compliances to various applicable laws changing in this dynamic condition.

In order to relieve difficulties arising from such circumstances, the government has temporarily relaxed few compliances. This Blog post discusses the measures undertaken with respect to securities and companies law.

SEBI Relaxations

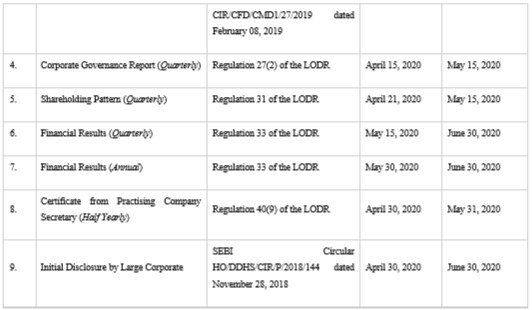

SEBI issued three circulars dated March 19, 2020[1], March 23, 2020[2] and March 26, 2020[3] respectively relating to SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015, relaxing certain important compliances such as the periodic filing requirements for listed companies and relaxations in the conduct of meetings under the aforementioned Regulations.

Certain important relaxations are mentioned below in a tabular format for better understanding.

Following such relaxations made by SEBI, the Ministry of Corporate Affairs ("MCA") issued a circular dated March 24, 2020, wherein certain relaxations were made to reduce compliance burdens.

Moreover, SEBI issued a circular dated April 23, 2020[4] relaxations under Regulation 24(i)(f) of SEBI (Buy-Back of Securities) Regulations, 2018, which provides a restriction that the companies shall not raise further capital for a period of one year. Such a one-year period may be reduced to six months and it will be applicable till December 31, 2020.

SEBI also clarified that the relaxations introduced vide circular dated March 19, 2020, shall apply to both listed companies with listed securities as well as to companies with listed NCDs/NCRPSs. The public issuance of NCDs/NCRPSs and CPs have been extended till May 31, 2020, instead of until March 2020. The stipulated gap of 120 days between two meetings held in six months currently being the period from December till June as enshrined under Regulations 17(2) and 18(2)(a) of the LODR, 2015 has also been relaxed. However, the Board of Directors will need to ensure that they meet at least 4 times a year. The Standard Operating Procedure circulars dated May 03, 2018[5] and January 22, 2020[6], the latter being for the imposition of fines for non-compliance of LODR, 2015, will continue to apply till June 30, 2020, whereas the imposition of fine will come into force from June 30, 2020.

The Takeover Regulations also provided relaxations to the holder of 25% or more shares or voting rights and to promoters of listed entities, from filing disclosure of their aggregate shareholding and voting rights as on March 31, 2020. Through the circular dated March 27, 2020,[7] the due date of filing the aforesaid disclosures under the SEBI (Substantial Acquisition of Shares and Takeovers) Regulations, 2011 for the financial year ending March 31, 2020, has been extended up to June 01, 2020.

MCA Relaxations

The MCA has allowed meetings to be conducted through video conferencing and other suitable means in the wake of such crisis till June 30, 2020. The Ministry issued such directions through the circular dated March 18, 2020,[8] and also inserted a new rule under Rule 4 of the Companies (Meetings of Board and its Powers) Rule, 2014 in order to put into effect.[9] Subsequently, the Ministry issued another circular dated March 24, 2020,[10] stating further relaxations by reducing certain important relaxations.

The additional fees which were to be charged for late filing of any document, statement etc., during the period from April 01, 2020 to September 30, 2020, will not be charged. The Companies Auditor Report Order 2020 which was applicable from 2019-20 will now be applicable from 2020-21. Moreover, the non-compliance of 182 days by at least one director of the company for being Indian resident is also being relaxed. The requirement under Schedule 4 of the Act, which requires the presence of non-independent directors in at least one meeting is also being relaxed and no such violation will be attracted.

In addition, relaxation has been provided for newly incorporated companies for filing the declaration for the commencement of business by six months, in addition to the existing six months. For the conduct of meetings, the board may extend up to 180 days between two consecutive meetings instead of 120 days till the next two quarters.

While clarifying upon the Corporate Social Responsibility through the circular dated March 23, 2020,[11] the funds may be allocated to PM-CARES fund making it an eligible activity.

Conclusion

Taking into consideration the disruption of business activities in the wake of the COVID-19 pandemic such relaxations are welcomed with respect to various statutory compliances, to focus on necessary measures to address the on-going threat. These relaxations combined with the MCA and IBBI authorities will help companies to reduce compliance burden and avoid penalties on account of unavoidable circumstances.

[1] http://sebi/HO/CFD/CMD1/CIR/P/2020/38. [2] http://sebi/HO/DDHS/ON/P/2020/41. [3] http://sebi/HO/CFD/CMD1/CIR/P/2020/48.

[5] http://sebi/HO/CFD/CMD/CIR/P/2018/77. [6] http://sebi/HO/CFD/CMD/CIR/P/2020/12. [7] http://sebi/HO/CFD/DCR1/CIR/P/2020/49. [8] http://www.mca.gov.in/Ministry/pdf/Meeting_18032020.pdf. [9] http://www.mca.gov.in/Ministry/pdf/Rules_19032020.pdf. [10] http://www.mca.gov.in/Ministry/pdf/Circular_25032020.pdf. [11] http://www.mca.gov.in/Ministry/pdf/Covid_23032020.pdf.

The opinions expressed herein are those of the author in their personal capacity and are not intended to be construed as legal, financial or investment advice.

Comments