Securitization Part 2/3 - Process Components

- Manal Shah

- Nov 25, 2018

- 5 min read

Securitization played its part in the 2008 Crisis. The structured financial technique involved several instruments.[1] Any literature on the crisis includes the concept of the role played by the ‘complex structured products’ in the process. There was a lack of understanding among investors about the nature of the structure would behave when a downturn took place resulting from the lack of understanding of the risks that these ‘complex’ products carried. There is no doubt that the credit rating agencies played a very negative role in leading investors into the dark. The Blog post aims to explain structured finance and its various components.

STRUCTURED FINANCE

According to the International Monetary Fund (2008), structured finance entails aggregating the multiple underlying risks (market and credit risks) by pooling instruments subject to those risks, e.g. bonds, loans and mortgage-backed-securities) then dividing the resulting cash flows into tranches or slices, paid to different holders. Payouts from the pool are paid to the holders of these tranches in a specific order, starting with the least risky tranches and working down through levels to the least risky tranches. Accordingly, if the expected cashflows failed, then post cash flow buffer depletion, the equity tranche holders first absorb the payment shortfall eventually the next set of tranche holders do not receive full payment. The Least risky tranches (senior tranches) at the top of capital structure are constructed to qualify for AAA credit ratings meaning there should be a very low probability of their not receiving promised payments. Right before the crisis, even the riskier tranches were rated highly.

COMPONENTS

Two asset classes Asset-Backed Securities (“ABS”) and Mortgage-Backed Securities (“MBS”) are the broadest most characteristic parts of Securitization (Securitization is explained here). Each of these classes created by pooling of mortgages and assets respectively. The 1990s saw the growth and development of ABS and MBS in the US, Europe and the U.K.

Mortgage-Backed Securities (MBS)

In the U.S., Ginnie Mae (the Government National Mortgage Association), Fannie Mae (the Federal National Mortgage Association) or Freddie Mac (the Federal Home Loan Mortgage Corporation) practically issued all mortgage-backed securities.

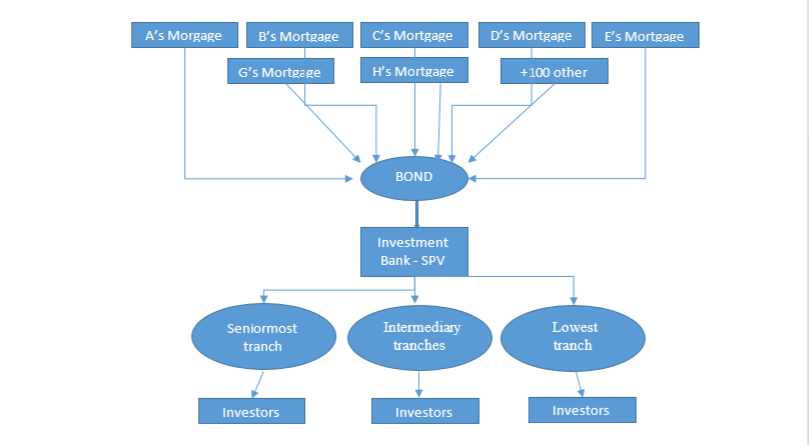

When a bank issues a mortgage which would generate interest. Earlier banks would keep these banks loans for the entire period until its maturity. Banks started seeing this to their detriment in view of the waiting period and the lack of money in their hands, this led to the development of MBS. The Banks started pooling such several mortgages (in huge numbers) along with the interest it would generate into a bond which would be sold to investment banks who would then classify and categorize parts of this into tranches (high risk, low risk etc) and willing investors would invest in these tranches depending on their risk capacities,. Hence basically, mortgage-backed securities are an avenue to invest in real estate pool. This way, banks did not have the need to wait until the maturity period to generate profits and create more loans. Repayments from underlying loans meant repayment to the end investors.

Residential mortgage backed securities (RMBS) are mortgage backed securities involving the debt obligation arising from a residential debt like home loans and mortgages. These involve a mix of fixed-rate mortgages, floating rate mortgages and also mortgages with adjustable rates (the most popular during the crisis). Their complexity depends upon the investor’s risk capacity. It also involves prepayment risks. The financial downturn of 2008 saw an unfortunately high rate of foreclosure in the U.S.

Commercial mortgage backed securities (CMBS) are mortgage backed securities involving obligations arising from debt in mortgages pertaining to commercial real estate such as factories, office spaces, industrial spaces, malls etc. Commercial mortgages are typically set for a specific term and have a comparatively less prepayment risk.

Asset-Backed Securities (ABS)

Similar to MBS, ABS involves a pool of assets as its collateral however these assets are not mortgages but distinct assets such as credit card loans, student loans, car loans, royalties etc. Similar to MBS, an SPV buys and administers these assets and divides these into tranches for investors of different investment appetite. While individually these assets are illiquid, when pooled together, like in the case of MBS, these become liquid and attract investors as well as their investment bringing in cash inflow which gives issuers, mostly banks, an opportunity to further lend. Typically ABS has three tranches A, B and C (highest to lowest implying high investment grade to low grade).

Credit Card receivables ABS

While the process of securitizing loans has been around for over 30 years, the securitization of credit card receivables first began in 1987.[2]Similar to mortgage and other asset securitizations, the financial institution that originates the credit card receivables sells a group of these receivables to a trust.[3] The trust then creates and sells certificates backed by the credit card receivables to investors, which are predominately institutional investors. Its complicated nature of transactions requiring constant monitoring of various performance indices of its underlying receivables keeps retail customers at bay, Despite this, the underlying credit card receivables generate income to support the interest payments on the certificates.[4]

Student Loans ABS

Let’s say, A Company who is in the business of issuing student loans, loans X money to pursue education and in this regard gives him the cash. Now typically, X had to repay the loan with interest and within agreed timelines. Company A has issued several loans and views itself to have run out of cash to issue more loans. The repackaging is a result of this. Now by repackaging several of these loans granted to a hundred or thousand other like X and selling it to the SPV would fuel A with cash to create more loans. The SPV meanwhile would sort out its purchase according to risk averseness of investors and creates tranches based on maturity period, interest rate and the chance of default. Then there would be issued as securities like the bond it would create on ever tranche.

Other ABS include Car loans receivables and royalties etc.

Credit Default Swaps (CDS)

A CDS is a simple derivative contract used to transfer the credit risk of a corporate entity in this case, from one party to another. In a standard CDS contract one party purchases credit protection from another party to cover the loss of face value of an asset. A credit event occurs in case of bankruptcy, default and restructuring.

AIG was the biggest insurance company and when the real estate prices fell, the market value of mortgage backed securities took a free fall with repayments and investment losses, AIG’s capital reserved skyrocketed too. When collateralization requirements triggered it was found that AIG had an estimated 450$ billion of CDS contract approximating 100$ billion, but it did not have a 100$ billion. It had to be bailed out.[5]

Synthetic Collateralized Debt Obligations (SCDO)

A synthetic CDO is one that invested in CDS and triggers only when the credit event associated with CDS occurs. If it does, investors become responsible for losses.

Collateralized Loan Obligations (CLO) are basically corporate loans with low credit rating bundled together. This includes leveraged buyouts (purchase of control in a company using borrowed money).

Collateralized Bond Obligations (CBO) is similar to CLO and involves an investment grade bond backed by a pool of junk bonds which are not investment grade, however since the pool includes several types investment grade bonds, they offer enough diversification to be categorized as investment grade.

[1] João Pinto (Portugal), Paulo Alves (Portugal), The economics of securitization: evidence from the European markets, Investment Management and Financial Innovations, Volume 13, Issue 1, 2016.

[2] https://www.fdic.gov/regulations/examinations/credit_card_securitization/ch2.html.

[3] Ibid.

[4] Ibid.

[5] https://www.huffingtonpost.com/david-paul/credit-default-swaps-the_b_133891.html.

Comments