Security Token Offering: Compelling Regulatory Opportunity for India Part 1/3

- Manal Shah

- Jul 31, 2019

- 3 min read

In three parts, this Blog Series endeavours to expound on the legal principles which lay the foundation for the potential regulation of Security Token Offerings (“STO”) within India’s existing legal system. The first blog post explains the concept and features of ICO and the types of tokens. This is followed by the second blog post: a study of tests and treatments applied by a US Securities and Exchange Commission and proactive Swiss FINMA. The final part walks the reader through the current blanket ban-like situation prevailing in one of the world’s largest economies, India, for treatment of digital assets. By drawing correlation of the comparative basis to a line of Indian judgments defining securities, the Article envisages the alternative path for India’s Securities regulator, i.e. to regulate STOs.

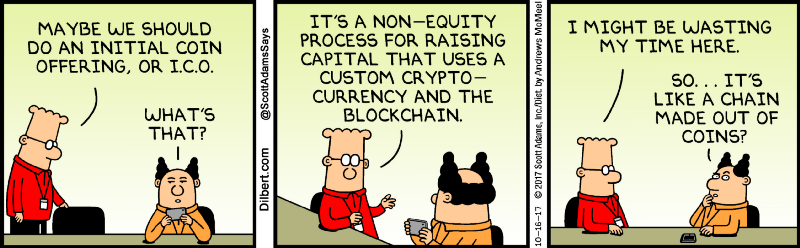

An Initial Coin Offering ("ICO") is, simply stated, the process of a cryptocurrency going public. But when you invest in an ICO, you do not become a shareholder of the company, you merely get a share of its market cap. Again, not the company. On the other hand, the somewhat lesser-known Security Token Offering ("STO") involves the underlying investment asset, more similar to an IPO.

ICOs are ordinarily carried out for a project where rights of ownership or royalties are sold. The majority of ICOs involve the creation of a predetermined number of coins or tokens. ICO prices are also predetermined by the creators of the project or Decentralized Autonomous Organization (“DAO”) or an economy. ICOs can have several rounds of fundraising and its early investors would likely be incentivized by the inclusion of better rewards embedded within their tokens. ICO Tokens are tradable in the open market on close of the ICO.

Decentralized nature and dearth of regulator’s jurisdiction fostered a practice for ICOs where companies/businesses willing to go out with ICOs release a White Paper elucidating the entire process with the nitty-gritty of the company/ business and the fundraising activity. In response to the White Paper, the investor receives a project’s coin, i.e. cryptocurrency of the project or a token.

U.S. Securities and Exchange Commission (“SEC”) has avowed that, grounded on specific facts, ICO may be securities offerings and fall under the SEC jurisdiction for enforcement of the Federal Securities Law.[1] It has time and again cautioned that ICOs being security offerings need to be registered with the SEC and has taken retrospective actions for the failure to do so.

Among the supposed particular facts, the most crucial is the sort of token issued. There are three main types of ICO Tokens. Utility Tokens are issued typically to raise funds and the buyer archetypally aims at procuring the product or service provided by the issuer platform. The primary peculiarity of these Tokens is that they can be utilized for cut-rate or premium access to something offered by the company. The supply of these tokens is preset, thus their value might appreciate or depreciate over time. Currency Tokens are chiefly used as a mode of payment, such as Bitcoin and Ethereum. The third breed of Tokens, i.e. Investment Tokens/ Security Tokens are notable as their economic role is akin to equity, bonds and derivatives. These tokens are backed by real assets and participation with participation rights, dividend/interest payouts and expectation of positive return on investment. For this reason, they are considered safest for investors. This also means, ICO of this category is regulated, making it more knotty than ICO for the earlier two types of Tokens.

The methodology adopted to regulate this new technological financial activity widely varies from state to state. World’s fifth-largest economy, India, has placed a blanket ban on virtual currencies (“VC”) and prevented registered financial institutions from dealing in and with VCs at all. United States of America (“US”) Securities and Exchange Commission has had an opportunity to assess several ICOs and has issued a Guideline earlier this year. Swiss Financial Regulator FINMA also published its guidelines for ICOs demonstrating the technologically neutral stance of its securities law. Notably, these attempt to regulate ICOs which have a securities element.

Recently, famous HBO TV Series Silicon Valley ended with the startup (Pied Piper) switching to ICO from a traditional VC Series B Funding.

[1] www.sec.gov/ICO (Last visited July 11, 2019).

Comments