What happened to World's once largest Crypto-exchange - The Mt. Gox Story

- Manal Shah

- Jun 14, 2019

- 2 min read

Jed McCaleb, a US Programmer and aficionado of the card game ‘Magic: The Gathering’ built a website for trading cards online in 2007. Mt. Gox was created as an acronym for the platform ‘Magic: The Gathering Online Exchange’. On envisioning the scope of cryptocurrency, McCaleb launched Mt.Gox.com as a Bitcoin Exchange in 2010 which by 2013 became the world’s largest cryptocurrency exchange handling about 70-80% of all bitcoin transaction. However, came 2014, Mt. Gox permanently shut its operations and went into liquidation.

Cryptocurrency: Type of digital currency that exists only electronically. Bitcoin is the pioneer and most prevalent cryptocurrency. Cryptocurrencies work in a decentralized fashion on the blockchain using the distributed ledger technology.

Cryptocurrency Exchange: Digital platforms facilitating the exchange of digital assets, they allow exchanging one cryptocurrency for another, buying and selling of cryptocurrencies and the exchange of fiat money into cryptocurrency.

Trading in cryptocurrency: Fiat money such as Rupee, Dollar etc can be used to purchase cryptocurrency using cryptocurrency wallets. These crypto-wallets have a designated address. In order to be able to trade for example, bitcoins with altcoins, one would require opening a trading account with the exchange platform. The coins would have to be transferred from the wallet to the corresponding cryptocurrency address on trading account. These coins can thereafter be traded on the exchange for other coins. Like the traditional stock exchanges, traders can opt to buy and sell coins by placing market order/ limit order.

Models of cryptocurrency exchanges: Most cryptocurrency exchanges are centralized, requiring the custody of digital assets in order to make trades. This model raises concerns related to custody of the purchased assets. Decentralized exchanges are in talks, these do not rely on any third party service to hold customer’s funds. Instead, trades occur directly between users (Peer to Peer) through an automated process.

Pricing on cryptocurrency exchanges: The exchanges can set prices, the prices differ on each exchange as each exchange gauges the price of bitcoin-based on its own volume of trades, as well as supply and demand of its users. Thus, the larger the exchange, the more market-relevant the price.

Mt. Gox

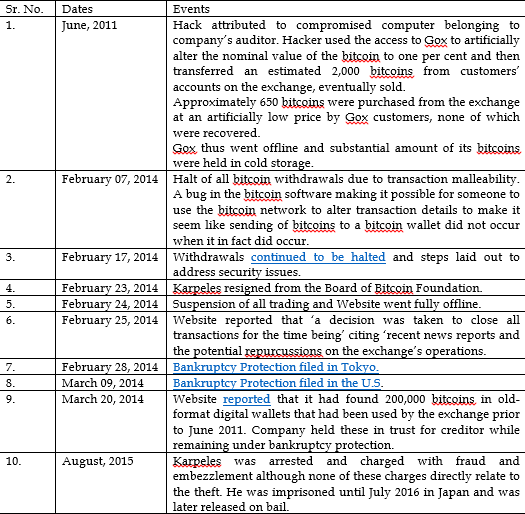

Mt. Gox was transferred to Mark Karpeles in 2011. Its massive market share gave it a significant role to play. As stated above, it saw 70-80% traffic of all cryptocurrency transactions. However, it became victim to a massive hack and lost about 740,000 bitcoins (6% of all bitcoins then in existence)[1]. This loss was valued at over USD 3 billion besides the additional USD 27 million found missing from Gox’s bank accounts. Out of these, 200,000 bitcoins were eventually recovered, the remaining 650,000 remained lost.

650,000 bitcoins remained unaccounted for as a result of Mt. Gox hack. In respect of how the hacker was able to access the bitcoins, various theories are in the air such as that the storage may have been compromised by an individual with on-site access to suggestions that the cold storage coins were gradually deposited into the Mt. Gox Exchange system when a hot wallet ran low and that lack of accountability among staff simply meant that there was no awareness about the wallets being drained by hackers.

Comments